vermont state tax rate 2021

Filing Status is Married Filing Jointly. The Vermont Department of Labor announced that its fiscal year 2022 July 1 2021 June 30 2022 state unemployment insurance SUI tax rates are determined on Rate Schedule III with rates ranging from 08 to 65 up from fiscal year 2021 where Rate Schedule I.

Vermont Income Tax Calculator Smartasset

5 rows The Vermont income tax has four tax brackets with a maximum marginal income tax of 875 as.

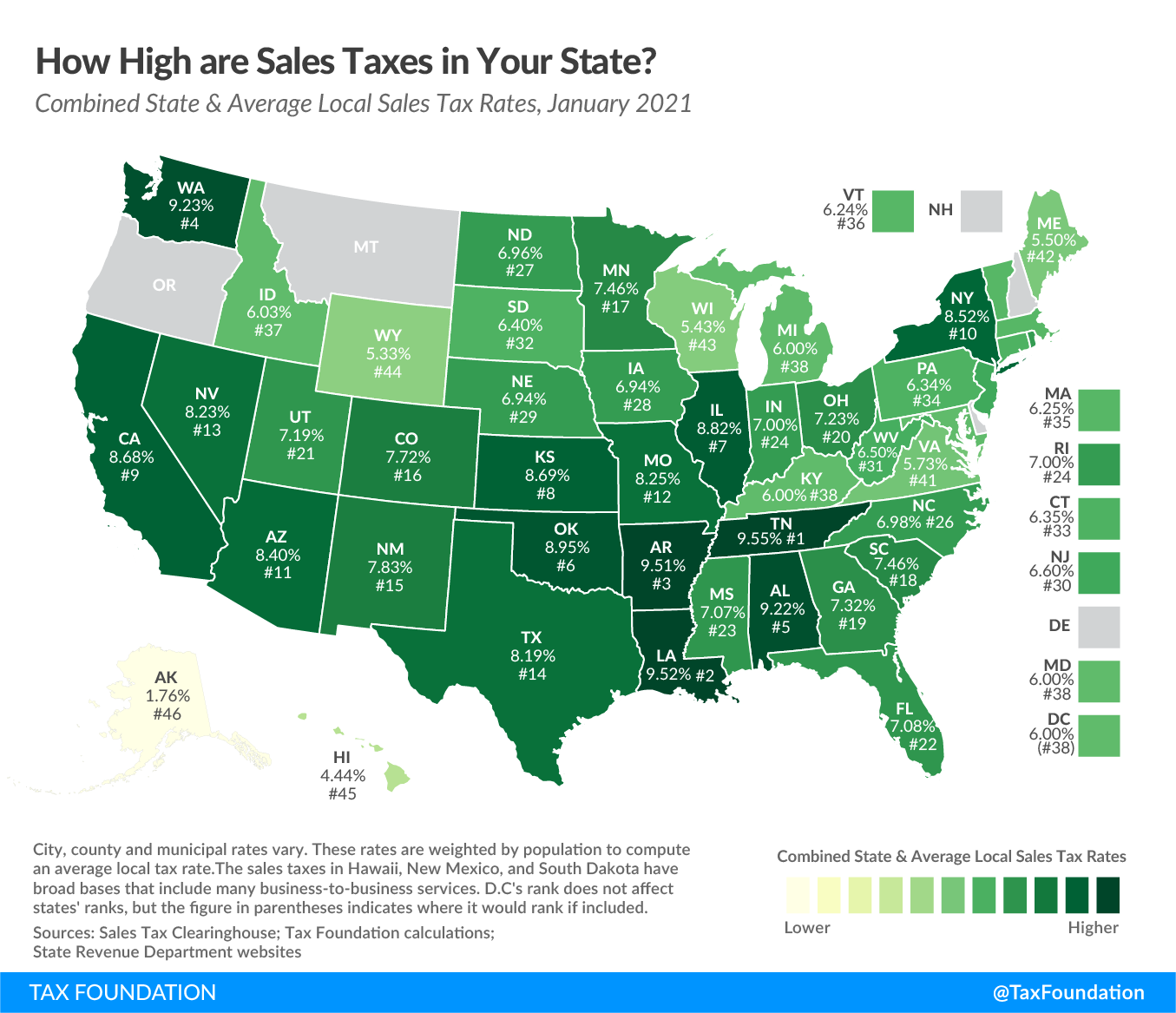

. Sign Up for myVTax. Fact Sheets and Guides. With local taxes the total sales tax rate is between 6000 and 7000.

Calculations are estimates based on tax rates as of. State government websites often end in gov or mil. FY2022 Education Property Tax Rates as.

W-4VT Employees Withholding Allowance Certificate. Tax Rates and Charts. The Vermont State Tax Tables for 2021 displayed.

PA-1 Special Power of Attorney. Vermont state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with VT tax rates of 335 66 76 and 875 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. At Least But Less Single Married Married Head of.

And your filing status is. 6 Vermont Sales Tax Schedule. Exemptions to the Vermont sales tax will vary by state.

Completed their reappraisal if reappraising in 2021. 2021 Income Tax Withholding. Location Option Sales Tax.

Check the 2021 Vermont state tax rate and the rules to calculate state income tax. Vermont State Tax Guide State tax rates and rules for income sales property fuel cigarette and other taxes that impact Vermont residents. Subtract 75000 from 82000.

2022 Interest Rate Memo. 31 2021 can be e-Filed in conjunction with a IRS Income Tax Return. Base Tax is 2727.

FY2023 Education Property Tax Rates have been set and are posted below for the towns that have. Before sharing sensitive information make sure youre on a state government site. State government websites often end in gov or mil.

B-2 Notice of Change. 5 rows 2021 Vermont State Sales Tax Rates The list below details the localities in Vermont with. Tax Rates and Charts Wed 08182021 - 1200.

At Least But Less Single Married Married Head of. With local taxes the total sales tax rate is between 6000 and 7000. By Tax Type.

Below are forms for prior Tax Years starting with 2020. Effective July 1 2020 to June 30 2021 tax rates for experienced employers are to be determined with Schedule 1 and range from 04 to 54 the spokesman told Bloomberg Tax in an email. PA-1 Special Power of Attorney.

FY2022 Education Property Tax Rates. Vermont state tax 4514. Vermont new heavy and civil engineering construction employer rate.

W-4VT Employees Withholding Allowance Certificate. Senior homeowners with 2021 household income of. Local Option Meals and Rooms Tax.

The major types of local taxes collected in Vermont include income property and sales taxes. Before sharing sensitive information make sure youre on a state government site. 2020 VT Rate Schedules.

9 Vermont Meals Rooms Tax Schedule. Details on how to only prepare and print a Vermont 2021 Tax Return. These back taxes forms can not longer be e-Filed.

2020 VT Tax Tables. IN-111 Vermont Income Tax Return. 2021 Vermont Tax Rate Schedules.

Passed their school budget and submitted it to Agency of Education and. Vermont School District Codes. Respond to Correspondence.

VT Taxable Income is 82000 Form IN-111 Line 7. Sales tax or use tax is any tax thats imposed by the government for the purchase of goods or services in the state of Vermont. Than filing filing house- jointly sepa- hold rately Then your VT Tax is.

On an annual basis the department and IRS conduct a cross match to ensure that employers are paying both taxes. Vermont announces an increase in state unemployment insurance tax rates effective July 1 2021. Multiply the result 7000 by 66.

Find your income exemptions. Find your pretax deductions including 401K flexible account contributions. Vermont Income Tax Forms.

Find your gross income. The state sales tax rate in Vermont is 6000. 2021 Vermont Tax Tables.

Vermonts unemployment tax rates for experienced employers are to decrease for fiscal 2021 a spokesman for the state Labor Department said June 23. Local Option Alcoholic Beverage Tax. How to Calculate 2021 Vermont State Income Tax by Using State Income Tax Table.

Vermont has recent rate changes Fri Jan 01 2021. IN-111 Vermont Income Tax Return. Vermont State Unemployment Insurance SUI.

Vermont State Income Tax Forms for Tax Year 2021 Jan. And your filing status is. Provided the state does not have any outstanding Title XII loans payment of state unemployment taxes in a timely manner reduces the federal unemployment tax rate from 60 to 6 so it is important to pay your state unemployment.

The education property tax rates for additional towns will be available on this website when their rates are set. TAX TABLES Place at. The Vermont sales tax rate is 6 as of 2022 with some cities and counties adding a local sales tax on top of the VT state sales tax.

If Taxable Income is. Summary as of June 28 2022. Here is a list of current state tax rates.

Any sales tax that is collected belongs to the state and does not belong to the business that was transacted with. Details on how to only prepare and print a Vermont 2021 Tax Return.

How Is Tax Liability Calculated Common Tax Questions Answered

Sales Tax By State Is Saas Taxable Taxjar

10 States With No Property Tax In 2020 Property Tax Property Investment Property

Liqour Taxes How High Are Distilled Spirits Taxes In Your State

Spirit Level Psychiatry Economics Spirit

Bank Of America Near Me Find Branch Locations And Atms Nearby Bank Of America America Bank

What Is The Most Valuable Fruit Crop Produced In The Peach State This Is Not A Trick Question But You May Want To Pause A Second Be Georgia Orange Fruit Peach

Lowest Highest Taxed States H R Block Blog

Pin By Eris Discordia On Economics Capital Market Chart Giant Market

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Sales Tax Definition What Is A Sales Tax Tax Edu

Vermont Income Tax Calculator Smartasset

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

More Than 1 In 8 Oklahoma Children Live In A Home Where The Head Of The Household Doesn T Have A High S Counting For Kids Education Issues Health Care Coverage

Does Your State Have An Individual Alternative Minimum Tax Amt

Vermont Income Tax Calculator Smartasset

Pin By Eris Discordia On Economics Capital Market Chart Giant Market

Gas Tax By State 2022 Current State Diesel Motor Fuel Tax Rates